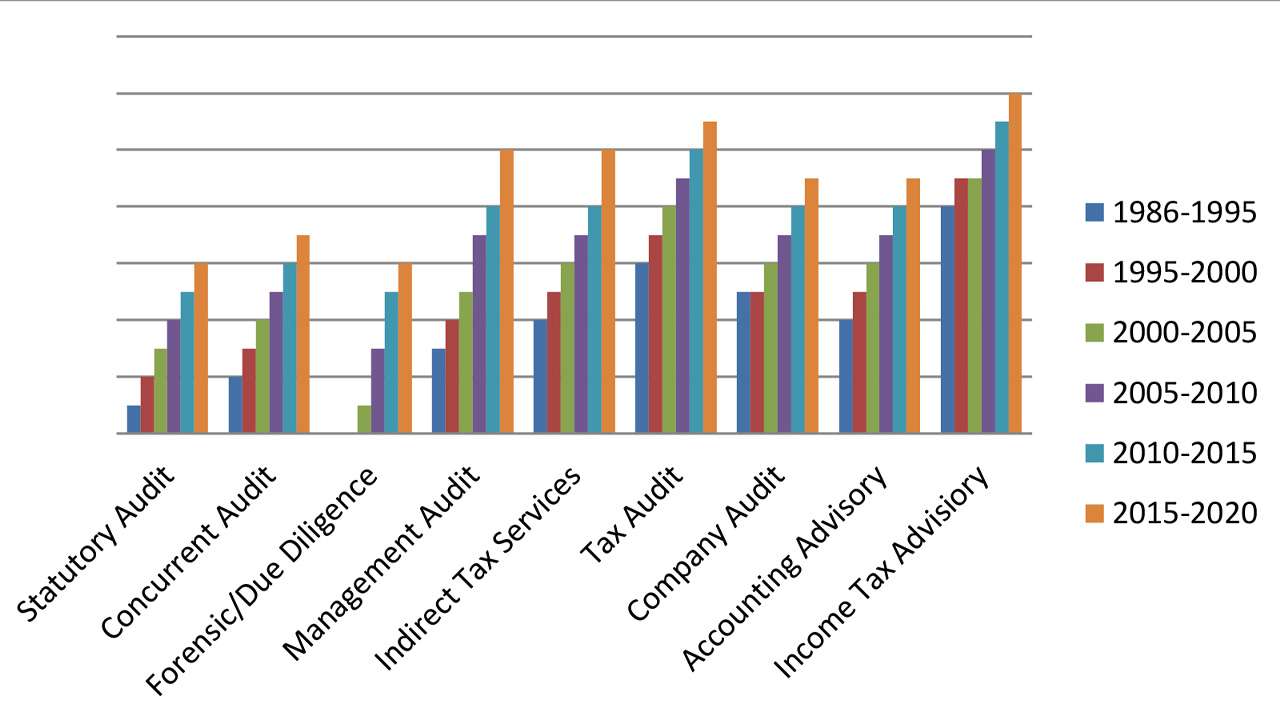

We have executed several Statutory Audit and Tax Audits of Firms and Corporate clients including Listed / Non Listed Public and Private companies.

We can provide effective Internal Control Audit / review to number of companies.

Firm is also providing Financial Advisory and consultancy services to few listed MNCs which include Telecom Industry, FMCG, NBFC, Banking Industry, Education Industry, Iron & Steel Industry, Cement Industry, Textile Industry etc.

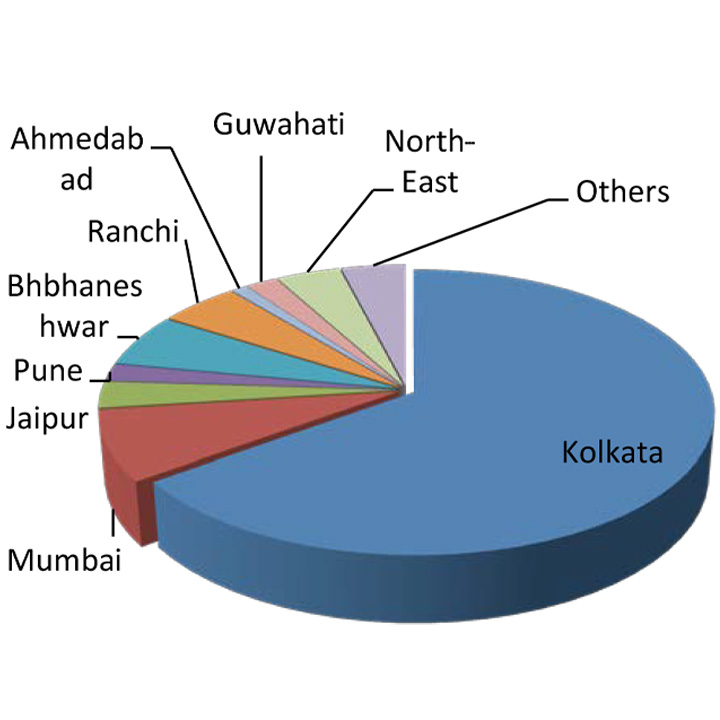

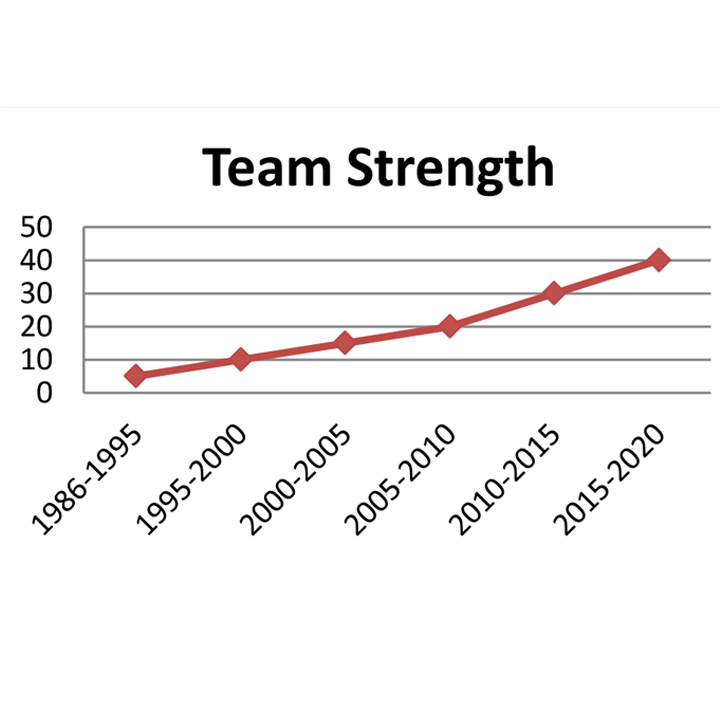

Firm has spread his wings not only in different sectors but also have been accepting different challenges w.r.t client needs. Our team have been able to help save MNC’s time and money by timely guiding on legal compliance, strictly following SOP and sharing timely reports with key observations.

In recent past, we have timely executed assignments with leading telecom player. We executed Inventory Management Services where in our findings gave impact of more than 5% to the total Inventory size of INR 5000 crore.

We efficiently managed team of 100 plus audit assistance for Pan-India execution of Inventory Audit of another telecom giant having revenue more than INR 22000 crore.

We have been able to successfully carry on Control Audit of a large MNC (Revenue crossing INR 22000 crore) consecutively 9th time in a row.

We are providing Forex Forecast Analytical service to a large FMCG company on monthly basis.

Our Inventory Audit to Homecare division of a large MNC has been appreciated by management.

We have been a Statutory Auditor of a Nationalised Bank and also executed several Concurrent Audit of various banks across India

Our findings / observations has been well acknowledged by the top management of banks.

We have provided Accounting Advisory services to various companies. This includes an E-Commerce company where in besides accounting service, we also provided Vendor Management consultancy service and Logistic Review services.

We also provided cost-benefit analysis to a successfully set project in Hotel Industry

We have executed couple of Corporate Social Responsibility Audits

.jpg)